A year after its rival Awfis made its market debut, Smartworks is poised to become the second Indian coworking startup to list on the exchanges. The coworking company’s highly anticipated public issue opens for bidding today.

Breaking Down The Smartworks IPO: The public issue comprises a fresh issue of INR 445 Cr and an OFS component of up to 33.79 Lakh shares. It has set a price band of INR 387 to INR 407 per share for its IPO, pegging the startup at INR 4,650 Cr at the upper end of the spectrum. In the run-up to the listing, it also raised INR 174 Cr from anchor investors.

Smartworks’ Sweet Spot: What may work in favour of the coworking startup is its asset-light model, significant scale (8 Mn sq. ft. of managed built-up area), strong sectoral tailwinds, and consistent growth — with a 39% CAGR in operating revenue between FY23 and FY25.

A key differentiator for the company is its focus on mid to large enterprises, which typically enter long-term contracts, contributing to greater business stability and revenue predictability.

Concerns, If Any? What may play a spoilsport for Smartworks is the ongoing market volatility, growing competition, market concentration (just four cities contributed 75% rental revenue in FY25), high capex and mounting losses, which jumped 26.5% YoY to INR 63.2 Cr in FY25 against an operating revenue of INR 1,374 Cr, up 32% YoY.

Can Smartworks Buck The Trend? The coworking major will be looking to emulate the success of Awfis, which listed at a premium of 12.8% last year, despite being a loss-making entity. However, markets have not been overtly patient this year. The only two new-age tech IPOs in 2025 so far – Ather and ArisInfra – have been a dud.

As far as Smartworks is concerned, markets are set to test its waters as it prepares to float its IPO today.

From The Editor’s DeskVarthana Nets INR 159 Cr: The education-focussed NBFC has secured the debt in a round led by BlueEarth Capital, with participation from Franklin Templeton Alternative Investments and responsAbility. Varthana offers low-cost loans to private schools and students.

JSW Ventures To Float Fund III: The JSW Group’s VC arm is looking to launch its latest fund with a corpus of INR 450 Cr. This comes as JSW Ventures has fully deployed its INR 300 Cr second fund, which backed the likes of Growcoms, Vetic and Zvolv, among others.

Jio Platforms Stalls IPO: RIL’s digital arm has decided to focus on improving business performance and growing its core operations before going public. In 2019, RIL chairman Mukesh Ambani had said the company would go for an IPO in five years.

More Troubles For Raveendran: A US Bankruptcy Court has held BYJU’S cofounder Byju Raveendran in civil contempt for failing to appear and submit evidence on time. The edtech’s US entity is in dock for allegedly transferring $533 Mn out of its $1.2 Bn term loan.

Starlink Set For India Debut: The satcom operator received the final regulatory approval after IN-SPACe granted the company the permit to commence commercial operations in the country. In June, Starlink also received the telecom ministry’s nod to kick off operations.

IndiGo’s Maiden Fund: The airline’s VC arm has marked the first close of its maiden INR 600 Cr fund at INR 450 Cr. It will back early-stage startups in aviation and allied sectors. As part of this, IndiGo Ventures announced an undisclosed investment in Jeh Aerospace.

Chai Bisket Nets $5 Mn: The digital content startup has raised the capital in its seed funding round led by InfoEdge Ventures and General Catalyst at a post-money valuation of INR 134 Cr. The startup produces regional content, manages influencers, and runs a film marketing agency.

Q-Commerce Under Scanner: The FSSAI has warned of strict action against ecommerce and quick commerce platforms for non-compliance with food safety norms. This comes close on the heels of Maharashtra authorities suspending the food licence of Blinkit and Zepto’s dark stores.

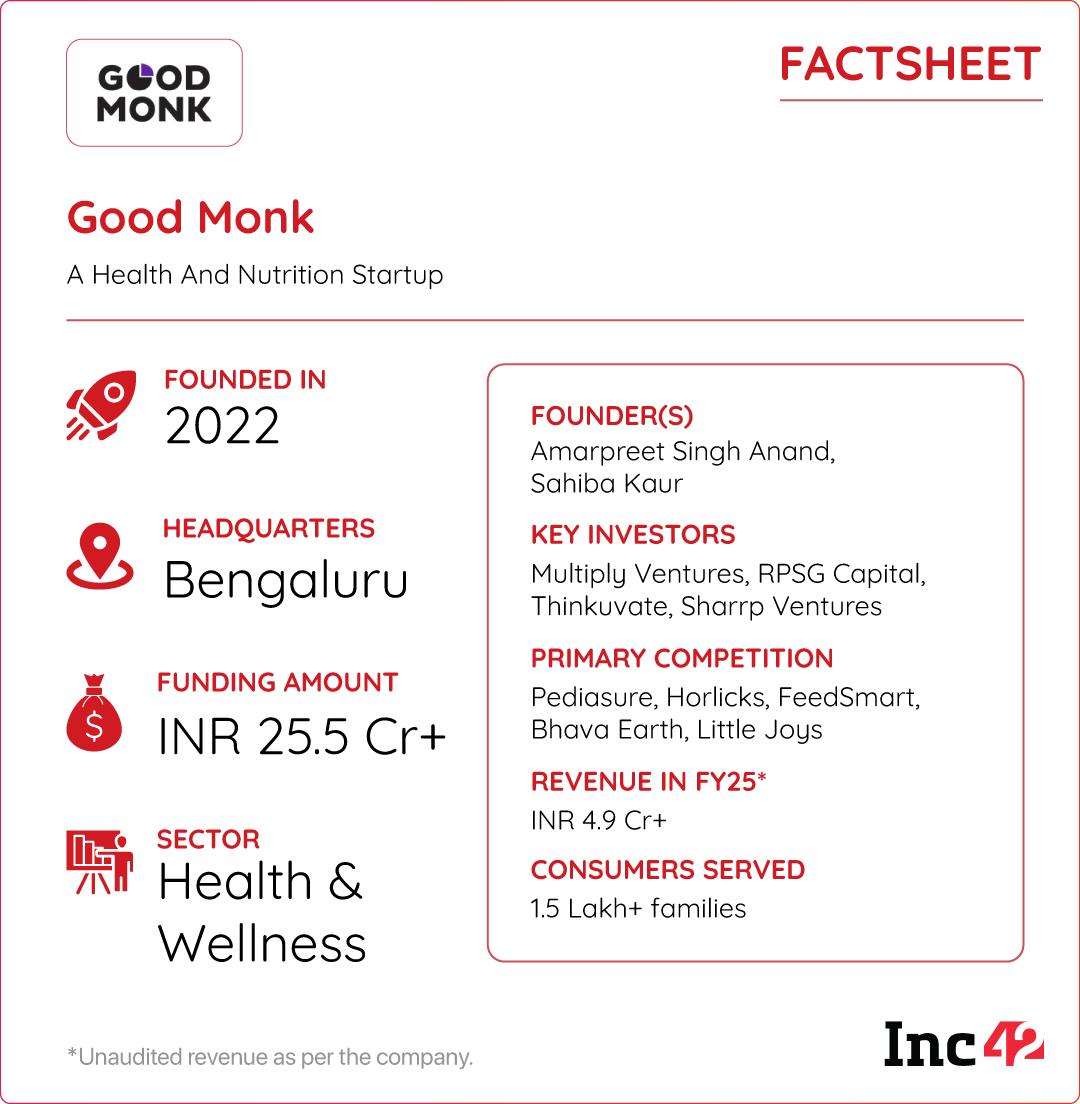

Inc42 Startup Spotlight Can Good Monk Take On Pediasure & Horlicks With Its Sprinkle-First Strategy?When Amarpreet Singh Anand discovered his son’s alarmingly low BMI during the pandemic, it exposed a bigger issue — over 80% of urban Indian kids suffer from micronutrient deficiencies. Existing options either tasted bad, were sugar-heavy, or lacked portion control, leaving parents frustrated and helpless.

Sprinkling Some Science: Determined to change the game, Anand and his wife launched Good Monk — a D2C health brand offering innovative, clean-label nutritional sprinklers. These easy-to-mix powders blend seamlessly into daily meals without altering taste, making nutrition effortless for kids and the elderly alike. The brand also offers probiotic and fibre-based products, all clinically tested and FSSAI-approved.

A Spoonful Of Market Potential: In just over a year, Good Monk has grown 5X, clocking INR 4.9 Cr in FY25 revenue with 1 Lakh+ users and 51% retention. Backed by investors like Multiply Ventures and Sharrp Ventures, it now aims for another 5X leap, banking on quick commerce and wider retail presence.

With legacy giants and new-age startups eyeing the same pie, competition is heating up. But its first-mover edge, clinical proof, and family-first approach could keep it ahead in India’s fast-growing nutraceutical race. Can Good Monk maintain its lead and become a household name in daily nutrition?

The post Smartworks Sets Sail For D-Street, Varthana Nets INR 159 Cr & More appeared first on Inc42 Media.

You may also like

3rd Test: Kumble says keeping England under 300 is key

Odisha: Chief Manager (Mining) MCL in CBI net over graft charges

33 best Amazon Prime Day deals on tried-and-tested products our experts love

ED probes Chhangur Baba's assets, accounts in UP religious conversion case

India to host major international shooting events in next three years