Paytm just about managed to remain in the black in Q2 FY26. Despite robust growth in its top line and improving EBITDA margins, the company’s profits shrank considerably due to a statistical illusion.

Here is a snapshot of Paytm’s Q2 numbers:

- Net profit stood at INR 21 Cr, down 98% YoY and 83% QoQ

- Operating revenue rose 24% YoY and 7% QoQ to INR 2,061 Cr

- Total expenses declined 8% YoY to INR 2,062 Cr

- EBITDA margin improved to 6.8% from -24% in Q2 FY25

Ghosts Of The Past: The profits reported in Q2 FY25 were not a result of operational efficiency or growth, but the result of a one-time gain from the sale of Paytm’s entertainment ticketing business. Paytm also had to write off an impairment of INR 190 Cr in Q2 FY26 against a loan given to First Games, its real money gaming joint venture.

Paytm’s Growth Levers: On the positive side, Q2 growth was driven by a 25% YoY rise in payment services revenue and a 63% surge in top line from financial services distribution. Growth was further fuelled by a tighter leash on expenses and higher stickiness of its lending products among merchants.

Rights Issue On The Anvil: Setting its sights on payments as the next growth driver, the fintech major plans to raise up to INR 2,250 Cr via rights issue to fuel its arm, Paytm Payments Services Ltd. The goal: raise money to fund expansion and boost cash reserves.

With international foray and much more lined up for the coming months, here is how Paytm fared in Q2.

From The Editor’s Desk Porter Axes 350 Jobs- Fresh off its $200 Mn round and unicorn milestone, the logistics unicorn has laid off 350 employees, or 18% of its total workforce. The retrenchments resulted from merging its truck and two-wheeler verticals to eliminate operational overlaps.

- Founded in 2014, Porter claims to host 3 Lakh drivers and 20 Lakh SME customers, handling everything from enterprise goods movement to intercity courier services and relocation.

- The layoffs are part of the startup’s broader push for agility as it targets sustainable growth and reins in high operational costs ahead of its potential IPO in the next 12-15 months.

- The fintech major’s net loss shot up by 694% YoY to INR 28.6 Cr in Q2 FY26, driven primarily by a 7% YoY decline in its revenues to INR 270 Cr and an exceptional loss of INR 11.8 Cr due to fraud carried out by some of its merchants and users.

- MobiKwik’s financial services vertical, primarily its lending business, saw an uptick thanks to higher disbursals QoQ and improved net margins

- Post-earnings, MobiKwik shares continued to dwindle, reflecting market apprehensions to another loss-making quarter.

- The eyewear giant’s IPO closed with a bumper 28.26X oversubscription. The overwhelming response came on the back of heavy interest from QIBs and NIIs.

- At the upper end of its INR 382-402 price band, Lenskart would be valued at INR 69,726 Cr, with key investors and promoter Peyush Bansal selling shares in the IPO

- The company’s valuation raised many concerns over the past week, with critics questioning its OFS-heavy IPO and a high P/E ratio of 237X against a profit of mere INR 297 Cr in FY25.

- Groww closed the first day of its public issue with a 57% subscription, receiving bids for 20.63 Cr shares against 36.47 Cr shares on offer. Retail investors led the pack with 1.91X subscription, followed by NIIs (0.21X) and QIBs (0.1X).

- The company is planning to raise INR 6,600 Cr via its public listing, which comprises a fresh issue of INR 1,060 Cr and an OFS component of up to 55.72 Cr shares.

- Many have panned the IPO for its OFS-heavy nature, mounting pressure on Groww’s core revenue engine and regulatory headwinds. However, Groww has aggressively diversified into credit, AMC, and wealth advisory to hedge against the revenue risk.

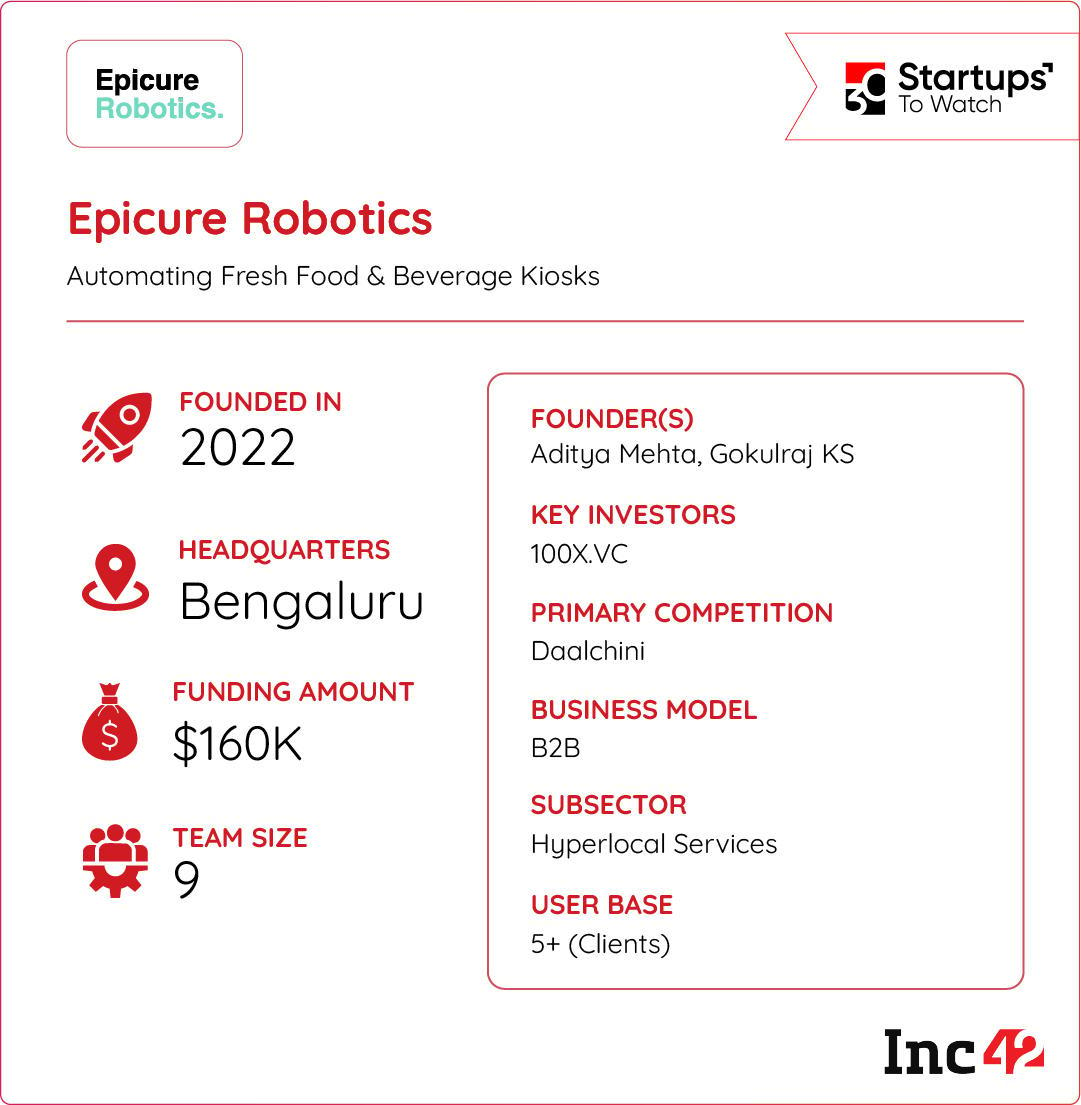

Food preparation at restaurants continues to be marred by challenges such as rising labour costs, quality inconsistencies and hygiene issues. This makes efficiency and scalability elusive. Enter Epicure Robotics, a startup that is trying to automate food making.

Making Food Preparation Smart: Founded in 2022, Epicure Robotics’ proprietary platform combines precision robotics with modular dispensers and analytics software to produce custom beverages and food autonomously, reducing reliance on labour and ensuring consistency.

Plug-and-Play Robotic Kiosks: Epicure’s modular kiosks can deliver 40+ beverage options in under 60 seconds, combining rapid service with contactless safety. Operational in Bengaluru, the startup’s product stack can transform traditional kiosks and QSR outlets into smart, efficient, and hygienic automated sites.

Tapping India’s Automation Wave: As more and more QSR chains embrace automation, Epicure is leveraging this momentum to reshape food retail across India to dip its toes in India’s billion-dollar food robotics market. But can Epicure Robotics become the backbone of India’s smart food retail?

India’s new-age tech giants, such as Swiggy, Ola Electric, BigBasket, PhonePe, and PharmEasy, posted staggering losses in FY25. Here are the top loss-making startups of the fiscal year.

The post Paytm’s Q2 Snapshot, Porter Cuts 350 Jobs & More appeared first on Inc42 Media.

You may also like

New dawn for women's cricket! From pay parity to World Cup glory — India have arrived

The little neighbourhood that boasts the UK's best high street - full of independent shops

A mayor of many firsts: From first Muslim to youngest mayor — What makes Zohran Mamdani's victory historical

Photos: See Haq actress Yami Gautam's stunning look in a saree..

Fire at retiree boarding house in Bosnia kills several people, media reports say