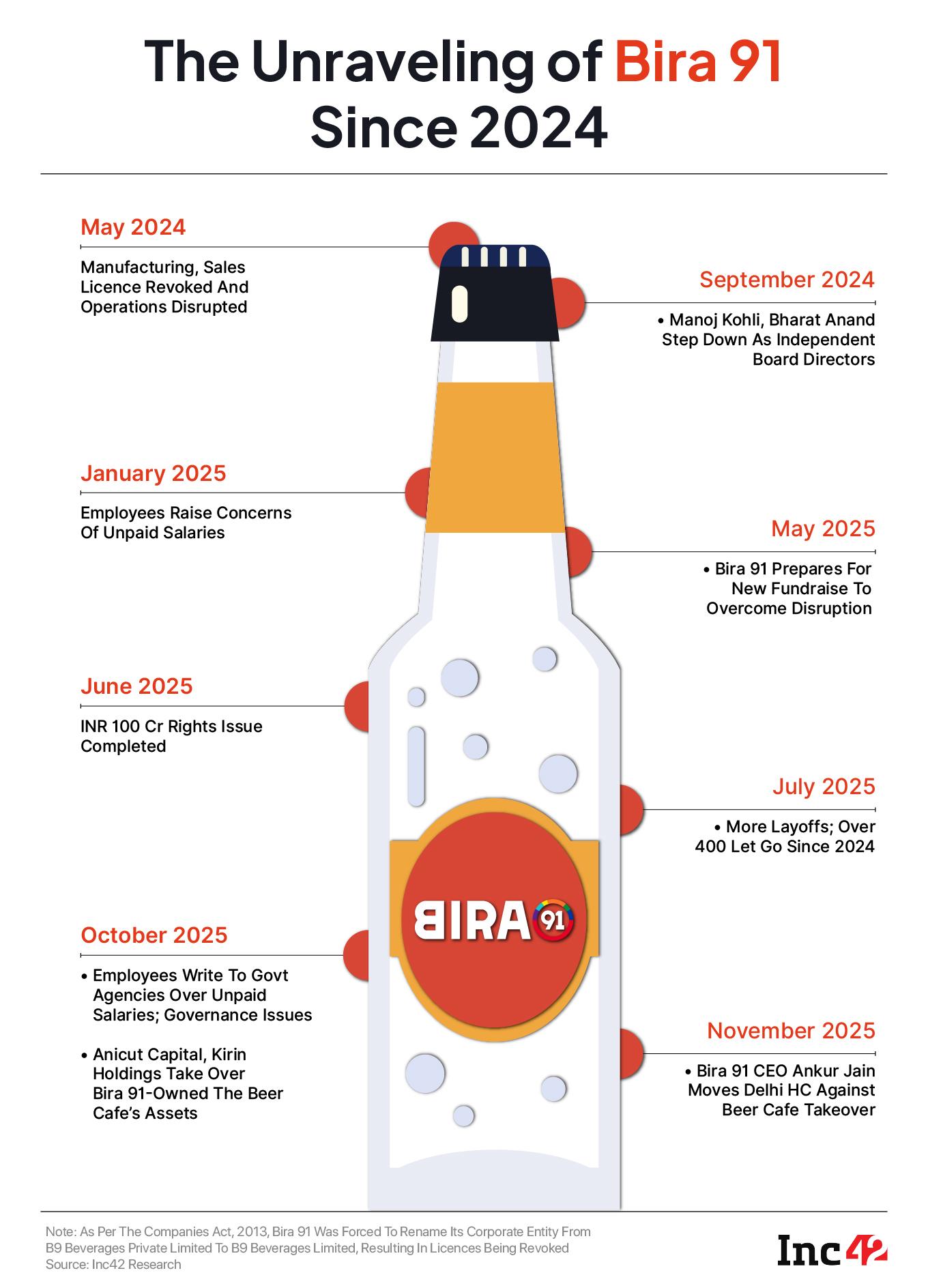

From a brand known for its cool urban image and setting the Indian craft brewery benchmark, Bira 91’s survival hangs by a thread.

The startup, which has raised more than $200 Mn in funding to date from investors such as Peak XV Partners, Sofina, and Kirin Holdings, among others, is struggling to move past the slowdown that hit its business last year.

At the centre of the storm are 600 employees, the investors, and Ankur Jain, the CEO and founder of B9 Beverages Ltd, Bira 91’s parent company.

Jain is under pressure to step down after a series of misfortunes for the company, including having to convert the parent entity from a private limited company to a public limited company.

More importantly, Jain and his family members on the board of the company have been alleged to have waived off recovery of excess remuneration for themselves in contravention of certain sections of the Companies Act. 2013.

Amid these allegations, there’s a battle brewing between Bira 91’s investors and the management to take over the assets of the company, even as employees claim that the situation was worsened by management inaction.

As per reports from earlier this week, the company may soon clear pending salaries and provident fund dues as the company moves to sell one of its assets.

Jain has reportedly informed employees that the planned sale is aimed at raising “immediate cash” to address dues and payment obligations, but no one is certain about which assets are being sold and to whom.

In fact, as of November 10, 2025, 8:30 PM, Inc42 was unable to access the Bira 91 website. It’s not yet clear whether this is related to any asset sales that the company has undertaken.

Bira 91 declined to respond to Inc42’s questions, but sources say the rot goes deeper than just a name change. Saddled with multiple concerns, the fate of one of India’s oldest craft beer brands is on the line. Here’s why Bira 91 is stuck in a quagmire.

Pressure Piles Up On Bira 91Amid piling losses and debts and business disruption, investors are reportedly locked in a legal battle with the CEO and other board members Ankur Jain’s mother Shashi Jain and his wife Ankeeta Pawa.

Sources claimed that at a recent company-wide meeting, Jain said he is willing to step down, however “shareholders aren’t willing to take over,” leaving the company in a limbo.

Shareholders, including lender Anicut Capital, are collectively demanding the resignation of Jain and his family members from the company. Notably, Kirin Holdings has a 20.1% stake in the company, whereas Jain and his family hold 17% stake in the firm, followed by Peak XV Partners which has roughly 4-5% equity.

“It has been brought to the notice of investors by employees themselves that gross financial irregularities have been happening at the firm which prompted them to act,” one of the sources close to the investors said.

Kirin Holdings and Anicut Capital reportedly have already taken over the assets of The Beer Cafe, the only profitable venture under B9 Beverages. The investors have invoked the clauses of convertible equity to take over this business

Jain has filed a plea in the Delhi High Court against the takeover, calling it unethical and in contravention of the contracts.

While Jain had earlier dismissed any discord between investors and the management, these court cases paint a different picture. It also hints at why former SoftBank India head Manoj Kohli and Khaitan & Co partner Bharat Anand. Both stepped down from their board observer positions last year.

Employee UnrestIt’s not just investors that are raising alarm bells. A group of employees has written to government agencies alleging that the company owes INR 50 Cr in dues for tax deducted at source (TDS).

Employees also claimed that Jain tried to downplay the impact of the business disruption last year, and that the situation has worsened despite the business resuming after a change in the operational model.

The letter points out that the Bira 91’s liabilities stand at over INR 1,400 Cr including INR INR 950 Cr in debt and INR 150 Cr in statutory dues, besides INR 300 Cr in vendor dues.

“The company lacks a functioning office due to unpaid rent, and there has been no formal communication from the CEO regarding employee welfare or future operations. Multiple related party transactions should be checked. Vendors and distributors are visiting the office regularly to get their dues cleared. Trade settlements are pending in various states,” the letter alleges.

The CEO told Inc42 in Maythat the cascading impact from the name change led to licenses being disrupted and the company’s manufacturing and sales completely coming to a halt. Besides the loss of business continuity, Bira 91 had to write off inventory worth INR 80 Cr, and had put vendor payments on hold for more than 4 months.

Overall, the company reported INR 748 Cr in net loss in FY24, with accumulated losses of INR 2,117.9 Cr and a negative cash flow of INR 42.2 Cr as of March 2024. The company’s financial statements for FY25 have not yet been disclosed.

Employees are demanding a forensic and financial audit of the company, and have sought the help of Bira 91’s investors.

In June this year, media reports claimed that Bira 91 had raised INR 84 Cr via a rights issue at a massive discount, but this was largely to repay debt and other dues. Jain had told Inc42 that Bira 91’s total liabilities as of May 2025 stood at INR 300 Cr.

Following the rights issue, sources say the company laid off employees, shrinking its workforce from 600 to 200 workers and has shut its main office and several of its owned manufacturing units.

Employees allege that the company is yet to pay salaries from July 2024, and that their statutory provident fund payments have not been paid by the company for more than 15 months.

Revolving Door For CFOsFinancial controls is one area where there are some concerns for Bira 91. Multiple CFOs have come and gone since 2019. This instability in the finance leadership indicates several concerns related to controls and audits.

Vinaya Jain, former General Motors CFO, was appointed in January 2019, but was replaced by Anil Arya, a senior finance veteran, in September 2020.

Arya was followed by Meghna Agrawal, the then VP of finance for alcobev giant Diageo, who came on board as the CFO in 2022.

When Agrawal also stepped away in July 2025, Vikram Qanungo, who was associated with Bira 91 from 2015 to 2019, was named as the CFO.

Speaking on the condition of anonymity, one of these former CFOs claimed their resignation was due to discord in the way financial audits were conducted.

The most recent independent auditor report for Bira 91 for FY24 had flagged various concerns, including the fact that the current liabilities exceed its assets by INR 487 Cr. It noted that B9 Beverages Ltd’s Belgium and Singapore units have outstanding loans worth INR 168 Cr and INR 213.3 Cr respectively and that the net worth of the subsidiaries is substantially eroded.

Corporate Governance Red FlagsThe Bira 91 board comprises Ankur Jain the CEO and founder as the promoter, his wife Ankeeta Pawa as another promoter director and his mother, Shashi Jain as a promoter director.

Nominee directors include Takaoka Sen from Kirin Holdings Singapore, Maxence Tombeur from Sofina, Sixth Sense Ventures’ Nikhil Vora and Peak XV’s Sakshi Chopra.

The board had also passed resolutions to waive off recoveries of remuneration to the three promoters, which contravenes various provisions of the Companies Act.

Under Section 197 of the Companies Act, 2013, a company cannot waive off the recovery of excess remuneration paid to directors unless this is approved by a special resolution within two years from the date the sum becomes refundable.

Additionally, if the company has defaulted in payments to banks or other financial institutions in due course of business, prior approval from those institutions is required before any special resolution for the waiver is sought from the board.

It is unclear whether B9 Beverages Ltd sought approval from its lenders or passed a special resolution for waiving off recovery of the excess remuneration.

All in all, the waiver meant that the company was not compelled to recover more than INR 4.5 Cr identified as excess remuneration paid to promoters and directors.

Ankur Jain’s excess remuneration was INR 48.58 Lakh for FY23 and INR 3.08 Cr for FY24. The excess remuneration for his wife Pawa was INR 3.10 Lakh and INR 45.66 Lakh respectively for FY23 and FY24.

Ankur’s mother Shashi Jain earned excess remuneration to the tune of INR 6.18 Lakh and INR 22.38 Lakh for these two fiscal years.

As per the most recent board resolutions, Ankur Jain’s salary for FY25 was INR 4.52 Cr. He will earn INR 4.79 Cr over the course of FY26 and INR 5.08 Cr for FY27. Pawa is set to be paid a remuneration of INR 1.66 Cr between FY25 and FY27, while Shashi Jain is set to earn more than 64 Lakh in FY26 and FY27 cumulatively.

Notably, the above resolutions were passed at a time when B9 Beverages appointed two independent directors, Ramaswamy Parthasarthy and Ashutosh Gupta, to its board.

While Jain earlier admitted to the financial troubles the company had faced in the past several years, it is unclear why the management sought remuneration hikes for itself when employee salaries were delayed, supply chain was halted and vendor payments were stuck.

The Downfall Of Bira 91Call it a marketing frenzy fuelled by VC money or aggressive expansion or overconfidence on the brand — the fact is that the situation at Bira 91 was not something anyone envisaged.

Many current and former employees attributed the downfall of Bira 91 to mismatch in business strategies between Ankur Jain and those that led finance, sales, operations and other verticals.

“At one point, it went on an overhiring drive while offering very high salaries compared to industry standards, poaching employees from top companies. The organisation was overly bloated in terms of headcount and employed double the number of employees that were needed across multiple offices,” a senior sales executive, who did not wish to be named, told us.

Plus, there was the fact that Bira 91 was constantly churning out new SKUs and experiments. Jain did not rest on the success of the existing brands despite being advised against the SKU pile-up. “He wanted new product launches every year even though we had some key brands like Bira Blonde and Bira White doing well,” another former employee claimed.

Bira 91’s overestimation of the market preferences and risky experiments dented its cash flow. Plus in FY25, the beer maker reported further decline in revenue with ballooning losses and manufacturing shut for most of the year.

“The sales are massively down since last year due to supply chain disruptions and unavailability of raw materials which further hit revenues. It remains unclear if they have shut the majority of their brewery units,” a former CXO associated with the company alleged.

Bira 91 expanded to more than 10 countries as it looked to create a new-age Indian beer brand. It was also the first Indian craft brewery to become an official sponsor of the International Cricket Council (ICC), for which the company reportedly spent $5 Mn – $6 Mn every year.

“Talk to any beer brand and they will tell you that barring Kingfisher which by the way is still the top beer brand across the country, there is no loyalty in this industry. It is a matter of volumes and occupying shelf space.,” he added.

Furthermore, the Indian market has seen an explosion of new brands competing with Bira 91, such as Simba, White Owl, BeeYoung, Kati Patang, and more?

This has contributed to an erosion of the brand in the market, with Bira 91 certainly not being as visible in the retail space as before. The state of the company’s affairs has not helped repair this dented image.

Even if Bira 91 is somehow able to pull off a miracle from here and gets a financial lifeline, it will require more than fresh capital for a turnaround.

The concerns related to corporate governance, misuse of funds and supply chain constraints are not easy to solve. Nor will it be cheap to win back customers, once the brand is up and running again. Competing with new age brands and international players will also come at a cost.

Being away from retail shelves for so long has hurt Bira 91 severely. And besides the challenges of the brand, there is a question of whether the company itself can survive amid the investor and employee pressure.

Whether Bira 91 can reclaim its fizz from here or serve, it is another cautionary tale for Indian startups and yet another instance of corporate governance and mismanagement derailing one of the biggest brands of its kind.

[Edited By Nikhil Subramaniam]

The post Inside The Bitter Collapse Of Bira 91 appeared first on Inc42 Media.

You may also like

xQc defends Sydney Sweeney over “great genes” comment, says outrage is pointless

Los Angeles Lakers vs Charlotte Hornets regular season game: Full injury report, who's out, and more (November 10, 2025)

I'm A Celeb LIVE: ITV jungle chaos as huge star pulls out days before launch

Malice on Prime Video release date, cast and 'creepy' trailer with X-Files legend

"Systematic stalling" weakens democratic traditions and prevents meaningful debate: Lok Sabha Speaker