He’s 20-something and was making INR 10-15 Lakh a month till a couple of weeks back. The self-styled middle-class Insta influencer calls himself “the face of fantasy cricket” in India.

“At least 90% of my income is gone,” lamented the “cricket trader” from Meerut, but refused to go on record when Inc42 tried to assess the impact of India’s recent ban on real money gaming on a buoyant influencer economy.

Let’s call him Krishna Dubey, whose tips on winning online fantasy games drew 2.7 Mn followers on Instagram and 72 Lakh subscribers on YouTube. His Telegram channel boasts of INR 200 Cr of prize money he won in cash. Not less than 90% of his brand collaborations were with RMG apps.

“I earned up to INR 15 Lakh in a month in the IPL season. My career is over now. And, it took barely a few hours,” said the youth. He poses with former Indian cricketers and flaunts a fleet of luxe automobiles – from Lamborghini to Defender – on his social media profiles.

Did real money gaming redefine the Indian middle class? Perhaps!

Dubey’s despair resonated across the country.

A beauty pageant winner-turned-reality TV star with 200,000 followers on Instagram and exuberant posts on almost everything – from lifestyle to beauty to fitness – said RMG app collaborations were driving 20-30% of her total income. She made INR 1-2 Lakh a month in peak seasons.

“I have collaborations with Whey Protein brands, fitness apps, beauty products, but RMG sponsorships fetched a huge chunk to my overall earnings, even though the windfall was limited to the IPL season,” she said, requesting anonymity.

In fact, most of the influencers refused to be identified, fearing further trouble in their disturbed lives. “Our dreams are crushed, our future is doomed,” rued a mid-level YouTube influencer. In fact, turned a pauper overnight.

His video on MSD’s likely mentoring of the Men in Blue attracted merely a few hundred pairs of eyes, while his winning tips on Dream11 fetched more than 10,000 views.

The user, Prince Cricket Expert, with his 44,000-plus subscribers on YouTube, sees the cul-de-sac.

The ban spelt doom for thousands of such influencers.

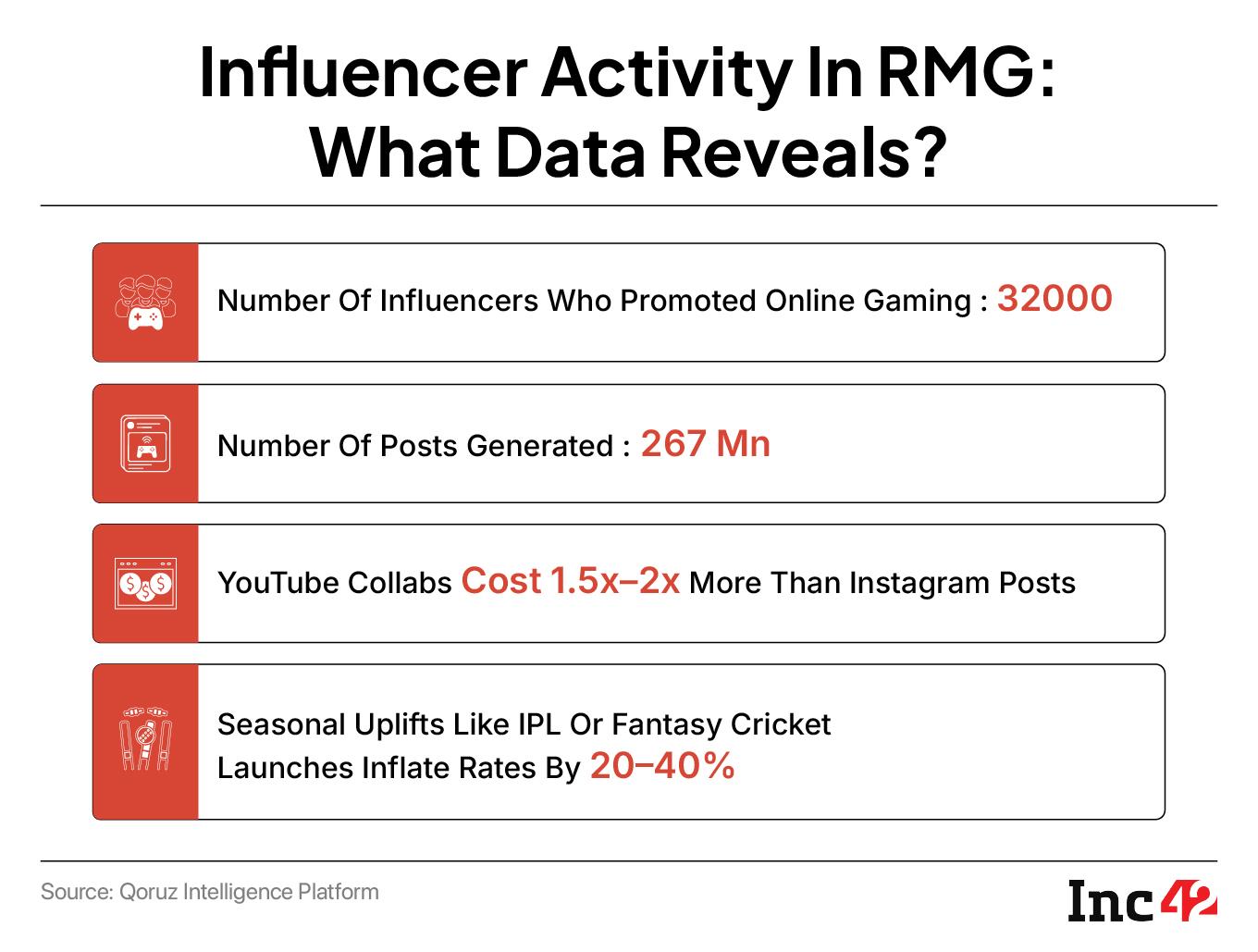

Exclusive data sourced from Qoruz, a creator intelligence platform, shows that over 32,000 creators had been actively posting content on real money gaming and fantasy sports since January 2024, building a pool of more than 68,000 posts and driving 267 Mn viewers.

Under the Chapter V of the law against real money gaming. “Up to three years’ imprisonment or INR 1 Cr fine (or both) for operating or facilitating RMG; up to two years or INR 50 Lakh for advertising, and enhanced punishments for repeat offences (up to five years’ imprisonment and INR 2 Cr for repeat operating or facilitation violations),” it said.

But little has changed, going by the stats from Qoruz. The average engagement rate across RMG collaborations stood at a healthy 2.42%. It denotes the percentage of followers engaging with a user’s content. “Anything above 2% is considered as good, while above 5% is excellent,” Qoruz cofounder Aditya Guruwara said.

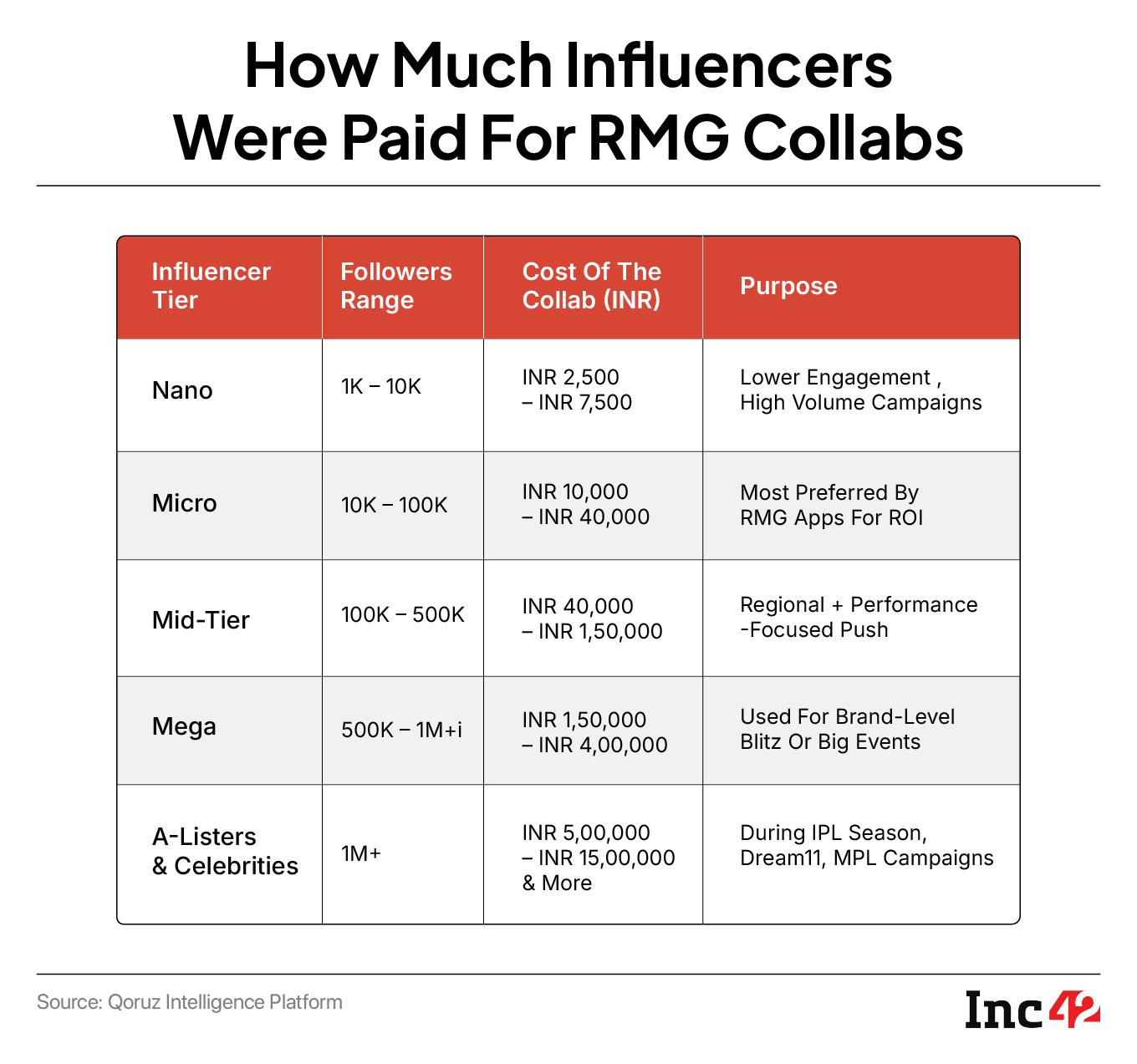

While a micro-influencer, with a following of 10,000 to 40,000, would earn INR 10,000 to INR 40,000 from a single collaboration with an RMG app, a mega influencer, with 500,000 to 1 Mn followers, would draw INR 1.5 Lakh to INR 4 Lakh per collaboration that could be for a post or a reel or for live streaming.

When it comes to celebrity influencers such as actors, cricketers and sportspersons, the payments would run into crores either as part of advertising deals or collaboration posts.

The Money Trail To InfluencersThe RMG collaborations were a huge source of revenue for India’s nascent influencer economy, with 33.98% of sports content creators and 28% of arts and entertainment content creators across social media platforms tying up with those apps, shows the Qoruz data.

Across nearly 400 RMG apps, the money flowing into digital platforms was unmatched, said GV Krisnamurthy, principal at brand consultancy AiNxtGen.

“The digital media industry had no parity when it came to advertising rates and it would not be an exaggeration to say that even for the likes of Google and Meta, the RMG companies were paying a premium to the normal pricings for better positioning, slots on OTTs, and so on. It almost became heavily tilted towards the RMG industry with other consumer brands unable to compete,” he said.

For influencers in particular, it was more of a matter of daily or monthly income, especially during the peak IPL season or world cricket championships, though there has been strict monitoring of gaming apps from the government.

RMG apps would rope in a particular marketing agency and ask them to engage mostly micro-influencers or those who connect with the mass in local dialects with a specific budget.

“As an agency handling both the ends of the industry, influencers and brands, we know how this budget would soar exponentially in case of bigger apps,” Rohit Agarwal, the founder and director of influencer marketing consultancy AlphaZegus Marketing, said.

He said most of the RMG apps weren’t necessarily concerned with the status of influencers, they wanted a mass connect in Tier II and III towns and beyond.

The influencers were tasked to either suggest a particular RMG app or create contents on how to play to win these games. Each RMG app expected that the influencers would ask the users or viewers to register on these apps, do a small transaction, or use some influencer code to play.

“This delivered customer acquisition and consequent spike in transaction volume for RMG apps that translated into real-time returns, unlike plain digital or broadcast advertising,” Agarwal explained.

A majority of sports influencers would go to the extent of helping the users or viewers create fantasy sports teams during major cricket events. This would attract revenue gains for influencers, besides payments from the RMG apps.

Industry stakeholders said Youtube and Instagram drove the maximum engagements.

“The trends we saw was that YouTube video integrations often cost 1.5-2 times that of Instagram posts. Creators from Tier-II and Tier-III towns often command higher gaming rates due to hyper-local audience conversion rates,” Guruwara mentioned.

Google’s stringent policies against gaming and online betting, however, often flagged content around any influencer promoting games of chance like gambling or betting which wasn’t the case on Instagram, multiple insiders shared.

The Ban And The BlowbackDigital advertising and influencer marketing companies complained that the ban on the INR 20,000 Cr real money gaming industry has pushed thousands into uncertainty. “Based on our estimates and industry analysis, the creator economy stands to lose INR 300-400 Cr in potential revenue due to the RMG ban,” Gurwara said. Multiple experts Inc42 spoke to estimate the toll in the same range.

For a fledgling creator economy, pacing up at 18% a year to reach INR 3,975 Cr by 2026, the ban on real money gaming has blocked the fastest growing revenue streams.

“Mid-tier and regional creators will be hit hardest, while the larger ones are expected to weather the headwinds. Scheduled influencer campaigns have been cancelled and payments have been frozen or delayed, as cash flow is hindered. Both agencies and influencers are now reworking their content pipelines,” he added.

Many brand consulting and influencer marketing firms had dedicated sports and RMG verticals which focussed on translating the advertisement costs of their RMG clients into better returns by strategising content with the influencers.

Along the money trail, Nishant Kinni, who founded advertising firm The Nische & Co, went a step further. “This too-good-to-be-true money came only during the edtech boom when companies like BYJU’S were going big on advertising and marketing spends. After the edtech downfall, companies like Dream11 and MPL filled that vacuum,” he said.

Industry insiders said that for any mid-to-large agency, a revenue of INR 50 Lakh-INR 1 Cr per month from RMG brands, especially around the peak cricket season, wasn’t unheard of.

Business, Blitzkrieg And BollywoodIndustry estimates suggest that RMG brands poured INR 8,000 Cr into digital advertising in the last five-six years, which accounted for 80% of their overall marketing spends.

“RMG has been a high-growth vertical, contributing 11% of India’s digital ad market and 7-8% of total ad revenue. Dream11 alone has spent nearly INR 5,700 Cr in the last six years on advertising, while Games 24*7 blew up INR 1,000 Cr on advertisements in the past three years,” Karan Taurani, executive vice-president of Elara Capital, said in a note.

The consulting firm estimates that the digital advertising industry growth will slow down by at least 300 basis points to 7.5% in FY25 from INR 70,000 Cr a year back when the industry was growing at 17% per year.

“We assess that elevated advertising rates will cool off due to aggressive bidding among RMG players. The post-ban white space could be chased by new-age platforms from ecommerce, consumer tech, legacy paan masala firms and discount stockbrokers,” Taurani said.

Gurwara of Qoruz predicts a slump in IPL viewership too. “We have not yet realised how a lot of OTT viewership, particularly of IPL, was closely tied to fantasy gaming platforms where the sole purpose of watching matches was playing fantasy cricket on RMG platforms. This ban is not only going to impact sponsorships and ad revenues for cricket tournaments, but also viewers,” he said.

In fact, various RMG platforms have begun diverting their funds to adjacent verticals. While Dream11 is leaning on FanCode (sports streaming), Dream Game Studios (casual IP), and DreamSetGo (sports tourism), MPL is working on free-to-play gaming and non-money engagements. PokerBaazi, on the other hand, plans to explore overseas markets and non-RMG games. Zupee, on its part, is doubling down on casual free titles such as Ludo and Snakes & Ladders, and WinZO is pivoting to a US launch.

An Elara Capital forecast says that the ban would wipe out 25% share of IPL ad revenue, which is nearly INR 15,000 Cr. “Money will now flow from fantasy sports to speculative trades, such as FNO and forex trading,” Taurani said.

The ripples are likely to hit the US shores, too.

Nishant Kinni of The Nische & Co Advertising sees a slight dip in ad revenues for Meta and Google, though India being a very small slice of the global revenue pie, the slump won’t bite it too hard.

For celebs and cricket stars, though, there’s a considerable loss in the offing. The Dream11 ad in the last IPL season had an unprecedented presence of Bollywood A-listers and cricketers. Some of them, however, didn’t engage with their followers on their social media profiles for promotion of RMG.

The downfall of real money gaming revives the memories of BYJU’s. Industry experts cautioned that the advertising industry and influencers and celebrities had seen such a slump a few years ago when BYJU’s fell, driving the entire edtech industry downhill. “This time, Dream11 and others replaced BYJU’s. This churn has almost become inevitable.” Krishnamurthy said.

While top celebrities and ad businesses may revive from the rough patch, small influencers may never find their footing again.

End Of The Road For Influencers?The government told Parliament that the rapid spread of online money games has created serious risks for individuals, families and the nation. “More than 45 Cr people are negatively affected by online money games and face a loss of more than INR 20,000 Cr because of it,” IT minister Ashwini Vaishnaw told the Upper House, explaining why the Centre moved to ban RMG.

The ban hasn’t just knocked out a gaming vertical – it has come as a blow to a fragile ecosystem of creators and influencers. In barely two weeks, that nascent economy has collapsed, leaving behind thousands of creators stranded, scores of agencies disrupted, and a thriving digital advertising market with a gaping hole in revenue.

A pivot to pure sports content doesn’t seem lucrative to the influencer community because of low engagement rates and scanty flow of funds. Some agencies expect a shakeout in the micro-influencer segment, with only those who diversify to regional language sports commentary, esports, or non-gaming categories surviving.

Others see this as a rebalancing. “The fundamentals were unsustainable. When one sector pays outsized premiums, it disrupts the market. The ban, painful as it is, will push influencers to diversify beyond a single revenue vertical,” said a senior executive at a digital agency, seeking to stay unidentified.

The history of real money games goes back over two decades. Once dominated by spurious, overseas third-party platforms, the industry became a large-scale money-spinner ruled by organised players in the last five-six years, fostering the perfect breeding ground for influencers.

Was the government action too much too late? As the debate rages on, the fate of influencers sink into an abyss of darkness.

[Edited By Kumar Chatterjee]

The post From Fantasy Cricket to Fallout: How Gaming Ban Crushed Creators’ Fate appeared first on Inc42 Media.

You may also like

Taliban back upgrade in ties as India explores ministerial visit

Nigel Farage tax return refusal dubbed 'another leaf from Trump's playbook'

Coughing, paralysis then death - doctors made up disease to save Jews from Nazis

Top union leader delivers warning to Labour as Keir Starmer hit by criticism

Billy Porter pulls out of Broadway show after 'serious sepsis' diagnosis