About a month ago, Ather Energy’s cofounder Tarun Mehta remarked that sales volume alone wouldn’t drive profitability, but product innovation would. In hindsight, it seemed like a subtle signal to the market, hinting at a likely decline in electric vehicle sales during the first quarter of FY26.

As per Ather’s Q1 FY26 results, the startup saw a 3% sequential decline in the vehicles sold to 46,708 units as against 47,411 in the previous quarter. This impacted the startup’s top line, which took a margin hit in comparison to the previous quarter.

In Q1 FY26, Ather Energy’s revenue from operations stood at INR 6,446 Cr, 3% hit compared to the previous year. Moreover, Ather’s revenue per unit declined by almost 4% on a sequential basis.

All these metrics suggest a poor quarter. However, on the very day of the result, Ather’s shares surged as much as 16%.

The reason behind this uptick is that, despite the company’s revenue decline on a sequential basis, the Bengaluru-based EV two-wheeler startup significantly reduced its losses by 26% on a sequential basis.

Moreover, it improved its overall margin, indicating a clear pathway for a road towards profitability.

Ather Energy Moves Toward ProfitabilityAther, which was listed on the public bourses two months ago, reported a drop in its net loss in its first quarterly report. The company’s net loss reduced by 26% QoQ to INR 178.2 Cr.

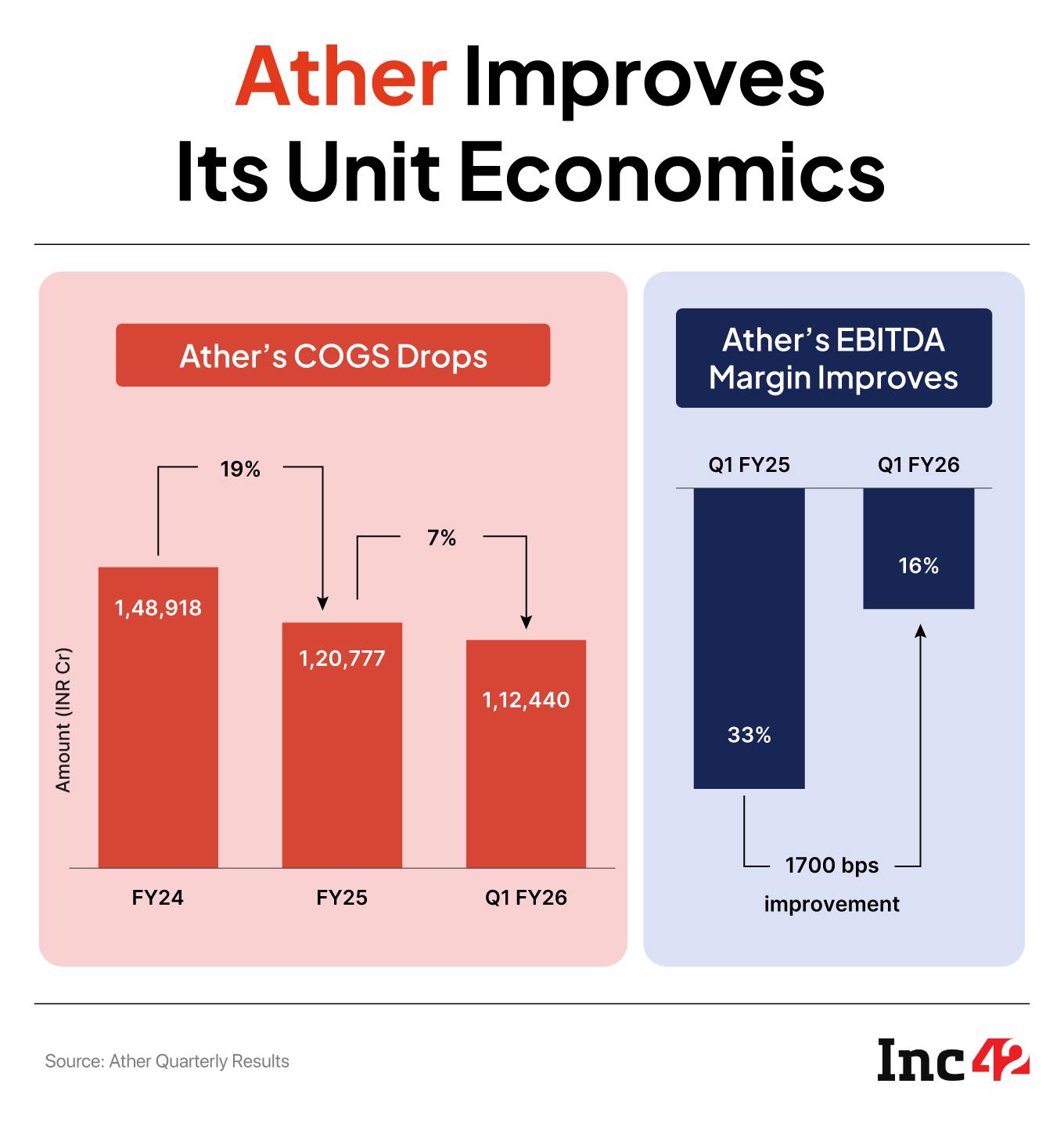

Ather, in its quarterly report, underlined that the drop in the loss is to be attributed to the company’s ability to bring down the cost of goods sold (COGS). The company’s COGS per unit, which means the direct cost required to sell a scooter, dropped to INR 1,12,440 in the quarter under review from INR 1,48,918 two years ago.

The company attributed the decline in COGS to a drop in battery cell prices, coupled with value engineering and better contribution from its affordable segment, which helped the company.

The company’s value engineering has come from its INR 89 Cr spent on R&D in Q1 FY26, which is significantly higher in comparison to other quarters. To top it off, the company highlighted that almost 45% of the company’s workforce is working on its R&D projects, further implying that the company’s gradual shift towards product innovation, something that Mehta had highlighted almost a month ago.

Moreover, what has helped the company to improve its unit economics is its product diversification, and more importantly, its foray into the budget segment.

You see, Ather has been synonymous with EV two-wheelers, which are priced premium. However, Ather’s launch of the Ritza scooters, a relatively cheaper alternative to its premium line of scooters, is helping the company address long-standing EV adoption barriers such as range anxiety and battery reliability, compounded with spacious seating design for family users.

While the low price tag has brought down the revenue per unit, the model has helped the startup to improve its unit economics. Besides sell of two-wheelers, Ather saw a gradual increase in revenue contribution of its non-vehicle revenue, fuelled by accessories, software, and services.

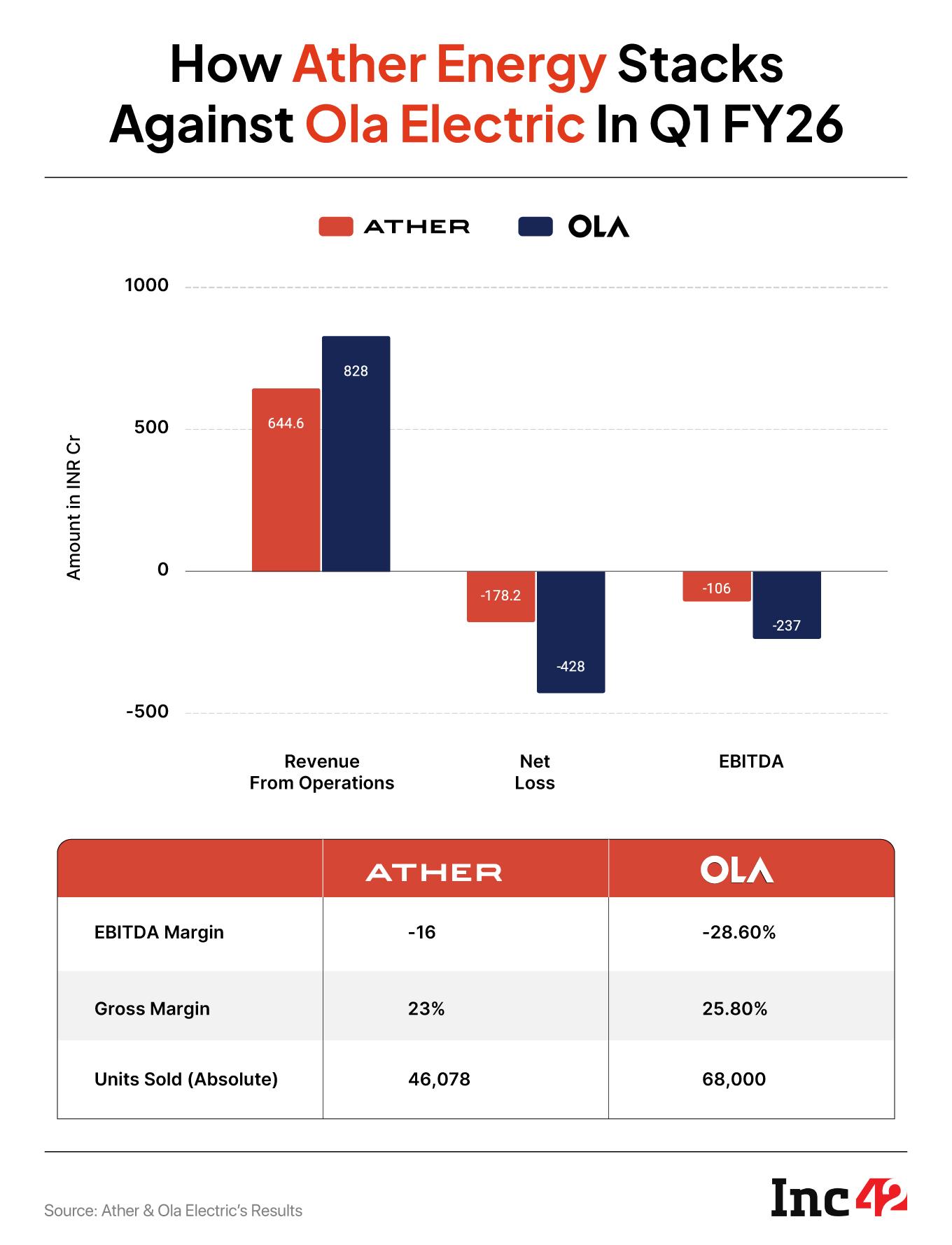

Ather Closes Ola Electric GapAther Energy’s financials can’t be looked at in silos, as it closely competes against Ola Electric. Both companies in the quarter under review have reported improvements in gross margin and cash efficiencies, but their path remain distinct.

Ola Electric saw its revenue from operations jumped 36% on a sequential basis to INR 828 Cr, in comparison to a 3% decline of Ather’s, despite the former continuing to remain over Ather Energy in terms of units sold.

Ola Electric’s increase in units sold stems from its broader product portfolio, aggressive pricing, and nationwide distribution via the D2C model.

Ola Electric’s gross margin of its auto segment jumped to 25.6% (excluding PLI incentive) supported by internal cost cuts and vertical product integration. On the other hand, Ather clocked gross margin of 23% (including PLI incentive) on the back of a more premium mix, ecosystem monetisation through its SaaS services, accessories, and cost control.

Concerning profitability, while Ola Electric’s auto EBITDA margin improved to -11.6%, the company’s auto segment’s loss stood at INR 261 Cr due to legacy warranty costs, subsidy reduction, and high operational expenditure. Besides, Ola Electric’s poor quality of electric scooters continues to add warranty-related expenses in its P&L statement, thus affecting the bottom line. Last quarter, Ola Electric took a one-time provision of INR 250 Cr to account for poor quality issues in its Gen 1 and Gen 2 scooters. In comparison, Ather’s EBITDA margin improved to -16% and an overall net loss of INR 172 Cr.

On a consolidated level, Ola Electric’s EBITDA margin improved to -28.6%.

While Ola Electric is banking on its cost reduction to improve margin gains, Ather has been investing in its R&D facilities and is prioritising product and platform innovation over short-term EBITDA gains.

Another contrast between the two lies in their battery strategy. While Ola Electric is pouring capital into its 4680 Bharat cell production with 1.4 GWh capacity already live, Ather relies on external suppliers and focuses on optimising battery performance through system-level integration. Ola Electric believes that the integration of in-house batteries in its scooters will bear positive results in the future.

However, at the moment, the cell segment continues to remain a drag for the Bhavish Aggarwal-led company with an EBITDA margin of – 1,579%.

What is more concerning for Ola Electric is the group’s negative cash flow from operations during the June quarter, which stood at INR 143 Cr. This compelled it to raise INR 1,700 Cr in debt.

While there’s no doubt that Ola Electric has a pan-India presence, with Ather Energy more focused in the southern state, Tarun Mehta-led company intends to address this, with expansion plans focused on middle India.

Moreover, Ather Energy has been slowly gaining momentum with respect to market share. In fact, in July, Ather Energy managed to reduce its gap with Ola Electric in terms of sales.

Edited By Nikhil Subramaniam

The post Ather Energy Is Closing In On Ola Electric’s Tail appeared first on Inc42 Media.

You may also like

'I saw Oasis at Wembley and three worrying details were accident waiting to happen'

20st crisp addict who ate 4 packets daily lost half her body weight without jabs

Gary Kirsten Reveals His Biggest Challenge As India's Head Coach Was Not Winning WC2011

Maruti Suzuki WagonR Crosses 1 Crore Global Sales, Driven by Over 32 Lakh Owners in India

BBC MasterChef winner 'feels awful' for John Torode as complaint left her 'gobsmacked'