US President Donald Trump’s threat of imposing tariffs as high as 250% on pharmaceutical imports is putting cheap supplies from Indian drugmakers at risk, with commonly prescribed oral contraceptives at the top of the list.

Approximately 65% of all birth control pill prescriptions in the US last year were manufactured by just two India-based companies, Glenmark Pharmaceuticals Ltd. and Lupin Ltd., according to a Bloomberg News analysis of data provided by health care intelligence firm Symphony Health.

While dependence on Indian imports and a narrow supply base is particularly acute for the birth control pills, some other drug categories are not far behind. Treatments for hypertension and depression are second only to birth control medication, with more than 50% of US prescriptions serviced by Indian generic drugmakers, the data shows.

Often dubbed the “pharmacy of the world,” India is the biggest supplier globally of cheap, non-patented medicines. The US is the country’s largest export market for drugs and accounted for exports worth about $9 billion in 2024, according to the UN Comtrade Database of global trade statistics.

The data analysis points to potential inflationary and supply chain shocks to the US health care system if Trump follows through on maximum punitive tariffs for pharmaceutical imports.

It also underscores the financial vulnerability of hundreds of Indian generic drugmakers that rely on US exports and tend to operate on wafer-thin margins due to intense price competition.

“We’ll be putting a initially small tariff on pharmaceuticals, but in one year — one and a half years, maximum — it’s going to go to 150% and then it’s going to go to 250% because we want pharmaceuticals made in our country,” Trump told CNBC in early August.

The Trump administration has so far not levied any tariffs on drugs.

Symphony’s data tracks US prescriptions and records the manufacturers’ name across batches of drugs. Many Indian firms also have production facilities in the US but granular data on specific drugs made in those plants — which wouldn’t be impacted by tariffs — is not available.

‘Tip of The Iceberg’

Soaring duties on imports could deter companies from prioritizing the contraceptives market, especially for low-margin generics, said Kim Villanueva, president of the Washington, DC-based National Organization for Women.

With over 65% of US women between the ages of 15 and 49 relying on pregnancy prevention drugs, family planning concerns are paramount but “just the tip of the iceberg,” she said.

Any disruption in supplies could “contribute to broader health care costs to manage other health issues,” Villanueva said, noting these pills are also prescribed for treatments such as period regulation, managing endometriosis and migraines.

Glenmark and Lupin declined to respond to requests for comment. The Indian Pharmaceutical Alliance, a lobby group that represents India’s top 23 drugmakers, didn’t respond to requests for comment.

But analysts said Indian producers likely will be forced to pass along any additional costs from tariffs to distributors or end users.

“These companies are hardly at a position to absorb these” tariffs, said Ann-Hunter van Kirk, senior industry analyst at Bloomberg Intelligence. She added that extreme levels of tariffs on imports would mean “it no longer makes sense for the company to even produce” drugs in India for the US market.

Revenue Generator

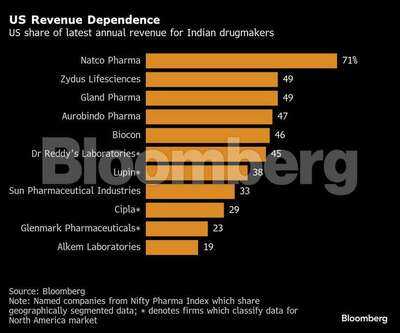

Some of India’s largest drugmakers, including Sun Pharmaceutical Industries Ltd. and Gland Pharma Ltd., get over a third of their revenue from the US, selling non-patented antibiotics as well as drugs treating everything from cancer to nervous system disorders.

The US already has imposed a 50% tariff on goods from India as a penalty for buying Russian oil, although levies on semiconductors and pharmaceuticals are still pending. The US initiated a Section 232 probe targeting the two sectors on April 1, and it’s unclear when duties for those commodities could be imposed.

Indian firms’ year-on-year US growth is expected to slow down to 3% to 5% compared with 10% in the year ended March 2025, rating agency ICRA Ltd., the Indian arm of Moody’s Ratings, said in a Sept. 18 note. The outlook for the US market is “cautious,” it added, with factors such as possible tariffs and regulatory scrutiny weighing on the Indian drugmakers.

Trump has also been pressuring the pharmaceutical industry to lower prices as well as move manufacturing to the US.

Trump sent letters to 17 of the world’s largest drugmakers including Eli Lilly & Co., Novo Nordisk A/S and Pfizer Inc., in August insisting they lower the prices of medicines supplied to Medicaid, the US government program for low-income Americans. He also asked them to guarantee future medicines be launched and stay at prices on par with what they cost overseas.

‘Bit of A Dance’

Overall, medicines from Indian companies provided nearly $220 billion in savings to the US healthcare system in 2022 and a total of $1.3 trillion in the decade through 2022, according to an assessment by pharma data provider IQVIA. Four out of ten prescriptions filled in the US in 2022 were supplied by Indian companies, it found.

The Trump administration is trying to force drugmakers to boost manufacturing in the US, van Kirk said, but its effort to incentivize that shift with tariffs on imports risks a spike in drug prices.

How they ensure lower prices “in a environment where they’re trying to repatriate manufacturing is a bit of a dance,” she said.

Approximately 65% of all birth control pill prescriptions in the US last year were manufactured by just two India-based companies, Glenmark Pharmaceuticals Ltd. and Lupin Ltd., according to a Bloomberg News analysis of data provided by health care intelligence firm Symphony Health.

While dependence on Indian imports and a narrow supply base is particularly acute for the birth control pills, some other drug categories are not far behind. Treatments for hypertension and depression are second only to birth control medication, with more than 50% of US prescriptions serviced by Indian generic drugmakers, the data shows.

Often dubbed the “pharmacy of the world,” India is the biggest supplier globally of cheap, non-patented medicines. The US is the country’s largest export market for drugs and accounted for exports worth about $9 billion in 2024, according to the UN Comtrade Database of global trade statistics.

The data analysis points to potential inflationary and supply chain shocks to the US health care system if Trump follows through on maximum punitive tariffs for pharmaceutical imports.

It also underscores the financial vulnerability of hundreds of Indian generic drugmakers that rely on US exports and tend to operate on wafer-thin margins due to intense price competition.

“We’ll be putting a initially small tariff on pharmaceuticals, but in one year — one and a half years, maximum — it’s going to go to 150% and then it’s going to go to 250% because we want pharmaceuticals made in our country,” Trump told CNBC in early August.

The Trump administration has so far not levied any tariffs on drugs.

Symphony’s data tracks US prescriptions and records the manufacturers’ name across batches of drugs. Many Indian firms also have production facilities in the US but granular data on specific drugs made in those plants — which wouldn’t be impacted by tariffs — is not available.

‘Tip of The Iceberg’

Soaring duties on imports could deter companies from prioritizing the contraceptives market, especially for low-margin generics, said Kim Villanueva, president of the Washington, DC-based National Organization for Women.

With over 65% of US women between the ages of 15 and 49 relying on pregnancy prevention drugs, family planning concerns are paramount but “just the tip of the iceberg,” she said.

Any disruption in supplies could “contribute to broader health care costs to manage other health issues,” Villanueva said, noting these pills are also prescribed for treatments such as period regulation, managing endometriosis and migraines.

Glenmark and Lupin declined to respond to requests for comment. The Indian Pharmaceutical Alliance, a lobby group that represents India’s top 23 drugmakers, didn’t respond to requests for comment.

But analysts said Indian producers likely will be forced to pass along any additional costs from tariffs to distributors or end users.

“These companies are hardly at a position to absorb these” tariffs, said Ann-Hunter van Kirk, senior industry analyst at Bloomberg Intelligence. She added that extreme levels of tariffs on imports would mean “it no longer makes sense for the company to even produce” drugs in India for the US market.

Revenue Generator

Some of India’s largest drugmakers, including Sun Pharmaceutical Industries Ltd. and Gland Pharma Ltd., get over a third of their revenue from the US, selling non-patented antibiotics as well as drugs treating everything from cancer to nervous system disorders.

The US already has imposed a 50% tariff on goods from India as a penalty for buying Russian oil, although levies on semiconductors and pharmaceuticals are still pending. The US initiated a Section 232 probe targeting the two sectors on April 1, and it’s unclear when duties for those commodities could be imposed.

Indian firms’ year-on-year US growth is expected to slow down to 3% to 5% compared with 10% in the year ended March 2025, rating agency ICRA Ltd., the Indian arm of Moody’s Ratings, said in a Sept. 18 note. The outlook for the US market is “cautious,” it added, with factors such as possible tariffs and regulatory scrutiny weighing on the Indian drugmakers.

Trump has also been pressuring the pharmaceutical industry to lower prices as well as move manufacturing to the US.

Trump sent letters to 17 of the world’s largest drugmakers including Eli Lilly & Co., Novo Nordisk A/S and Pfizer Inc., in August insisting they lower the prices of medicines supplied to Medicaid, the US government program for low-income Americans. He also asked them to guarantee future medicines be launched and stay at prices on par with what they cost overseas.

‘Bit of A Dance’

Overall, medicines from Indian companies provided nearly $220 billion in savings to the US healthcare system in 2022 and a total of $1.3 trillion in the decade through 2022, according to an assessment by pharma data provider IQVIA. Four out of ten prescriptions filled in the US in 2022 were supplied by Indian companies, it found.

The Trump administration is trying to force drugmakers to boost manufacturing in the US, van Kirk said, but its effort to incentivize that shift with tariffs on imports risks a spike in drug prices.

How they ensure lower prices “in a environment where they’re trying to repatriate manufacturing is a bit of a dance,” she said.

You may also like

Caste census: K'taka govt removes Christian tag; BJP calls it 'victory' of Hindu community leaders

MAFS star 'reveals' how much cast get for show as she complains about production

Nobel Prize for Donald Trump? Emmanuel Macron sets one condition; what he said

Donald Trump says NATO should shoot down Russian planes in WW3 threat

Emmerdale fans 'work out who got shot' by Cain - and it's 'not John'