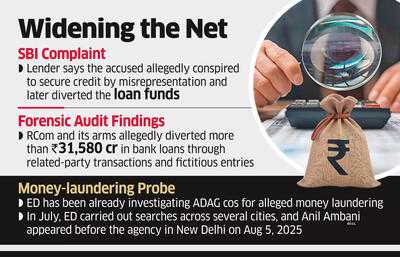

Mumbai: The Central Bureau of Investigation (CBI) has filed a case against Reliance Communications (RCom), its director Anil Ambani, and unnamed public servants for allegedly defrauding State Bank of India ( SBI) of nearly ₹3,000 crore.

The federal probe agency, armed with a search warrant from a special court, Saturday conducted searches at RCom's offices and Anil Ambani's residence in Mumbai, it said in a press statement.

According to SBI's complaint, the accused allegedly conspired to secure credit facilities from the country's biggest mass lender by misrepresentation and later diverted the loan funds.

The allegations include misuse of loans, circular routing of funds, inter-company transfers, misuse of sales invoice financing, discounting of bills by Reliance Infratel (RITL), inter-corporate deposits, write-off of advances to unlisted ADAG entity Netizen Engineering, and the creation of fictitious debtors.

Denying the allegations, a spokesperson on behalf of Ambani said that the businessman plans to challenge the case. The spokesperson added that SBI, by its own order, has already withdrawn proceedings against five other non-executive directors. However, Ambani has been selectively singled out. They said that Ambani has challenged SBI's declaration before the competent judicial forum.

"... The search at Anil Ambani's residence concluded early this afternoon. The complaint filed by SBI pertains to matters dating back more than 10 years. At the relevant time, Ambani was a non-executive director of the company, with no involvement in the day-to-day management," said a statement.

"...At present, Reliance Communications is being managed under the supervision of a committee of creditors, led by SBI and overseen by a resolution professional. The matter remains sub judice, pending before the NCLT and other judicial forums, including the Hon'ble Supreme Court, for the past six years," added the statement.

Audit Red Flags

The case is based on SBI's complaint supported by forensic audit findings of BDO India LLP, which examined transactions between April 2013 and March 2017.

The audit allegedly found that RCom and its subsidiaries diverted more than ₹31,580 crore in bank loans through related-party transactions and fictitious entries.

In its alleged findings, which is a part of the FIR, the auditor has said that RCom, RITL and RTL have transferred the bank loan funds internally among themselves. RCom has transferred ₹783.77 crore to RTL and ₹1,435.24 crore to RITL from loans from banks.

"It has been observed in various transactions that company/ management has not transferred directly to the company which requires funds but has made transactions through various associates/ subsidiaries. Reasons for the same have not been provided by the management or Anil Ambani," the FIR reviewed by ET reads. "...it appears that management of the company and promoter has done these transactions through manipulation of books of accounts to misappropriate the fund and breach of trust with dishonest intention," the FIR further adds.

RCom also used intraday credit limits from HDFC Bank to execute circular transactions involving Reliance Webstore (RWSL), which auditors said created "fictitious debtors" to mask exposure.

The federal probe agency, armed with a search warrant from a special court, Saturday conducted searches at RCom's offices and Anil Ambani's residence in Mumbai, it said in a press statement.

According to SBI's complaint, the accused allegedly conspired to secure credit facilities from the country's biggest mass lender by misrepresentation and later diverted the loan funds.

The allegations include misuse of loans, circular routing of funds, inter-company transfers, misuse of sales invoice financing, discounting of bills by Reliance Infratel (RITL), inter-corporate deposits, write-off of advances to unlisted ADAG entity Netizen Engineering, and the creation of fictitious debtors.

Denying the allegations, a spokesperson on behalf of Ambani said that the businessman plans to challenge the case. The spokesperson added that SBI, by its own order, has already withdrawn proceedings against five other non-executive directors. However, Ambani has been selectively singled out. They said that Ambani has challenged SBI's declaration before the competent judicial forum.

"... The search at Anil Ambani's residence concluded early this afternoon. The complaint filed by SBI pertains to matters dating back more than 10 years. At the relevant time, Ambani was a non-executive director of the company, with no involvement in the day-to-day management," said a statement.

"...At present, Reliance Communications is being managed under the supervision of a committee of creditors, led by SBI and overseen by a resolution professional. The matter remains sub judice, pending before the NCLT and other judicial forums, including the Hon'ble Supreme Court, for the past six years," added the statement.

Audit Red Flags

The case is based on SBI's complaint supported by forensic audit findings of BDO India LLP, which examined transactions between April 2013 and March 2017.

The audit allegedly found that RCom and its subsidiaries diverted more than ₹31,580 crore in bank loans through related-party transactions and fictitious entries.

In its alleged findings, which is a part of the FIR, the auditor has said that RCom, RITL and RTL have transferred the bank loan funds internally among themselves. RCom has transferred ₹783.77 crore to RTL and ₹1,435.24 crore to RITL from loans from banks.

"It has been observed in various transactions that company/ management has not transferred directly to the company which requires funds but has made transactions through various associates/ subsidiaries. Reasons for the same have not been provided by the management or Anil Ambani," the FIR reviewed by ET reads. "...it appears that management of the company and promoter has done these transactions through manipulation of books of accounts to misappropriate the fund and breach of trust with dishonest intention," the FIR further adds.

RCom also used intraday credit limits from HDFC Bank to execute circular transactions involving Reliance Webstore (RWSL), which auditors said created "fictitious debtors" to mask exposure.

You may also like

Gaganyaan: Isro completes key first integrated drop test

I went to M&S every day for a week to find yellow sticker bargains — they were best at 1 time of day

Telangana CM Revanth Reddy, Venkaiah Naidu pay tributes to Sudhakar Reddy

Man convicted in multi crore scam booked for cheating lawyer while out on bail

Pep Guardiola and Liverpool on collision course over £35m transfer as late exodus awaits